How to get a property tax deduction when buying an apartment?

If you're considering buying an apartment, it's essential to understand the potential tax benefits that may come with it. One such benefit is the property tax deduction, which can help reduce your overall tax liability. Here are some steps you can take to maximize your chances of getting a property tax deduction when buying an apartment.

Determine if you're eligible: The first step is to determine if you qualify for a property tax deduction. Generally, property tax deductions are available to homeowners who itemize their deductions instead of taking the standard deduction. Check with your local tax authority or consult a tax professional to understand the specific eligibility criteria in your area.

Keep track of your expenses: When you buy an apartment, you may incur various expenses related to property taxes. It's crucial to keep detailed records of these expenses, including any taxes paid at closing or throughout the year. These records will be essential when it comes time to claim your property tax deduction.

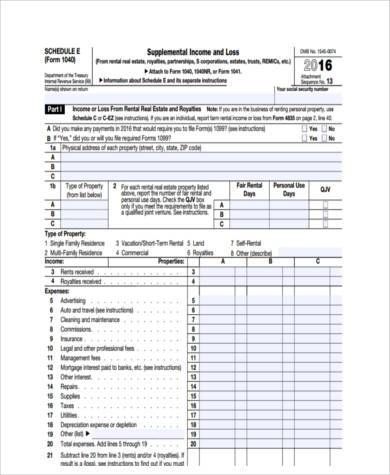

Obtain the necessary documentation: To claim a property tax deduction, you'll need to provide documentation supporting your claim. This typically includes copies of property tax bills or statements showing the amount you paid. Make sure to collect all relevant documents from the property seller or the tax authorities to substantiate your deduction.

Understand local tax laws: Property tax laws vary by jurisdiction, so it's essential to understand the specific rules and regulations in your area. Familiarize yourself with the local tax code to determine the maximum deduction you can claim and any additional requirements you need to fulfill.

Consult a tax professional: Tax laws can be complex, and it's easy to overlook potential deductions or make errors when preparing your tax return. Consider consulting a tax professional who specializes in real estate to ensure you're taking full advantage of all available property tax deductions. They can provide personalized advice based on your specific situation and guide you through the process.

File your tax return accurately: When it's time to file your tax return, ensure that you accurately report your property tax deduction. Use the appropriate tax forms and follow the instructions provided. Double-check your calculations and review your return for any errors or omissions before submitting it.

Keep up with changes in tax laws: Tax laws are subject to change, so it's crucial to stay informed about any updates or revisions that may affect property tax deductions. Subscribe to reliable tax publications, follow relevant government websites, or consult a tax professional regularly to stay up to date and make the most of your deductions.

Remember, getting a property tax deduction when buying an apartment can help reduce your overall tax burden. By understanding the eligibility requirements, keeping thorough records, and seeking professional advice when needed, you can increase your chances of maximizing your property tax deduction and enjoying the benefits of homeownership.