How to Create a Business Budget that Works

Whether you are a tech startup or an established tech company, managing your finances effectively is crucial for long-term success. One of the key components of financial management is creating a business budget that works. A well-planned and structured budget can help you make informed decisions about resource allocation, set realistic financial goals, and track your progress.

1. Determine Your Financial Goals

Before diving into the budgeting process, it’s important to define your financial goals. Are you aiming for revenue growth, cost reduction, or increased profitability? Clearly articulating your goals will not only guide your budgeting decisions but also provide you with a benchmark for measuring success.

2. Track Income and Expenses

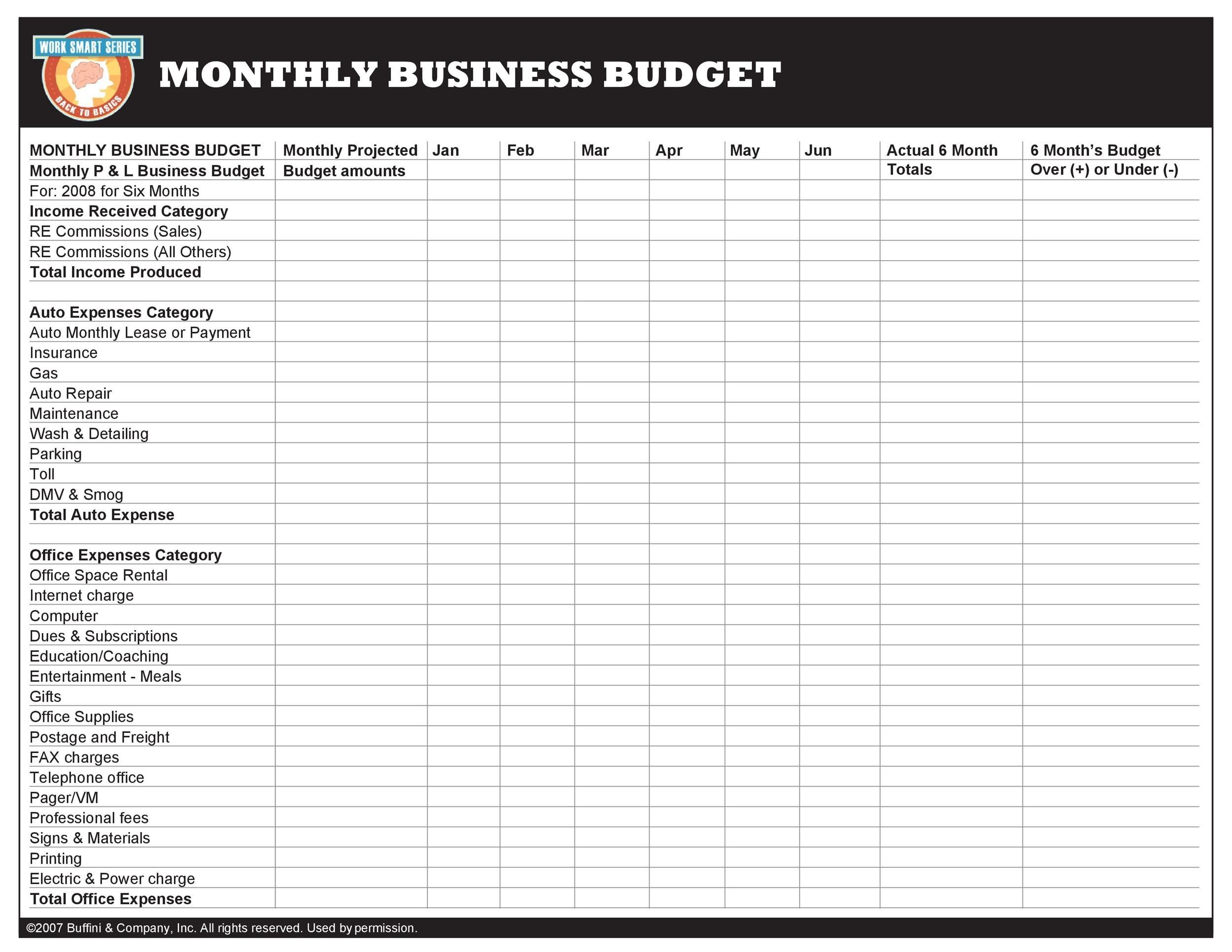

Start by tracking your income sources and expenses. Look at your past financial statements to identify sources of revenue, fixed costs, variable costs, and discretionary expenses. This data will serve as the foundation for your budget.

3. Categorize Expenses

Group your expenses into categories such as marketing, technology, employee salaries, rent, utilities, and so on. Categorizing your expenses will help you analyze spending patterns and identify areas where you can potentially cut costs or reallocate resources.

4. Set Realistic Targets

Based on your financial goals and historical data, set realistic targets for each expense category. Consider any upcoming projects, market trends, or seasonal fluctuations that may impact your financials. Setting achievable targets will help you avoid overestimation or underestimation of expenses.

5. Plan for Contingencies

Include a contingency fund in your budget to account for unexpected expenses or emergencies. This buffer will provide financial stability during uncertain times and ensure your budget remains resilient.

6. Review and Adjust Regularly

A business budget is not static; it requires constant monitoring and adjustment. Regularly review your financial performance against the budgeted targets. Identify any variations and analyze the reasons behind them. Make appropriate adjustments to your budget to maintain its effectiveness.

7. Leverage Technology

Utilize technology to simplify your budgeting process and enhance accuracy. There are numerous budgeting software and tools available that can automate calculations, generate reports, and provide real-time insights into your financials. Leverage these resources to streamline your budgeting efforts.

8. Seek Professional Advice

If budgeting seems daunting or if you lack the necessary expertise, consider seeking professional help. A financial advisor or an accountant specialized in the tech industry can provide valuable insights and recommend best practices tailored to your specific business needs.

Conclusion

A well-designed business budget is critical for effectively managing your tech company’s finances. By setting clear goals, tracking income and expenses, categorizing expenses, and regularly reviewing and adjusting your budget, you can ensure financial stability and make informed decisions to drive your business forward. Embrace technology and seek professional advice when needed to optimize your budgeting process and maximize your chances of success.