Financial education plays a critical role in empowering individuals with the knowledge and skills they need to make informed financial decisions. In an increasingly complex and fast-paced world, it is essential for individuals to have a solid foundation of financial literacy to navigate the challenges and opportunities of managing their personal finances.

The Importance of Financial Education

Financial education is not just about managing money; it is about understanding how money works and how to make it work for you. It equips individuals with the skills and knowledge to budget effectively, save for the future, invest wisely, and avoid common financial pitfalls. By developing these skills, individuals can take control of their financial destiny and build a secure financial future.

Moreover, financial education is crucial for fostering economic growth and stability at both the individual and national levels. It promotes financial inclusion by empowering marginalized communities and individuals with the knowledge and tools they need to access financial services and build wealth. Studies have shown that countries with higher levels of financial literacy tend to have stronger economies and lower levels of poverty and inequality.

The Role of Workshops in Financial Education

While financial education can take various forms, workshops are a particularly effective means of delivering financial education to individuals. Workshops create an interactive and engaging learning environment where participants can ask questions, share experiences, and receive personalized guidance on their financial journeys.

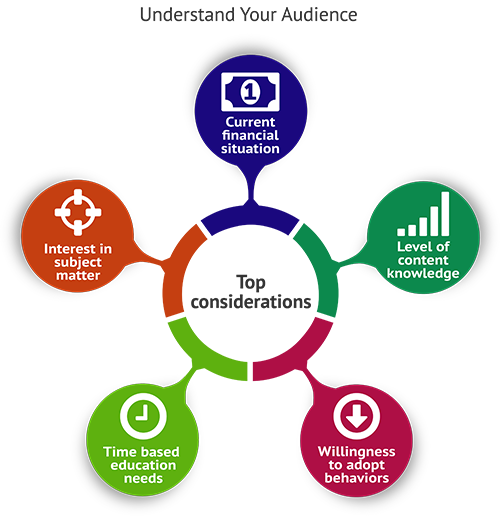

One of the key advantages of workshops is their ability to address individual needs and circumstances. Unlike one-size-fits-all financial education programs, workshops allow participants to focus on specific topics or areas of interest that directly relate to their financial goals and challenges. Whether it is budgeting, debt management, retirement planning, or investing, workshops can provide tailored information and resources to meet participants’ unique needs.

Furthermore, workshops create an opportunity for participants to learn from experts and industry professionals. By bringing in financial advisors, bankers, and other financial experts, workshops provide participants with access to specialized knowledge and insights. These experts can demystify complex financial concepts, explain the latest trends and regulations, and offer practical tips and strategies for financial success.

Key Benefits of Financial Education Workshops

Financial education workshops offer several benefits that make them an invaluable component of a comprehensive financial education strategy:

1. Interaction and Engagement:

Workshops foster active learning through group activities, discussions, and case studies. This interactive approach enhances engagement and helps participants apply their learning to real-life situations.

2. Networking Opportunities:

Workshops provide a platform for participants to connect with like-minded individuals and build a network of support. This networking can lead to valuable collaborations, partnerships, and mentorship opportunities.

3. Skill Development:

Workshops equip participants with practical skills and tools they can immediately apply to improve their financial well-being. From developing a budgeting plan to managing credit effectively, participants gain actionable knowledge to take control of their finances.

4. Empowerment and Confidence:

By attending financial education workshops, individuals gain confidence in their ability to make informed financial decisions. This empowerment can have a ripple effect, as financially educated individuals are more likely to positively influence their families, communities, and future generations.

Conclusion

In a world driven by money, financial education is a necessity rather than a luxury. It empowers individuals with the tools and knowledge they need to navigate the complex financial landscape, make informed decisions, and achieve financial well-being. Workshops offer an effective and engaging way to deliver financial education, providing tailored information, expert insights, and networking opportunities. By investing in financial education and workshops, individuals can take charge of their financial lives, build wealth, and secure a brighter future.