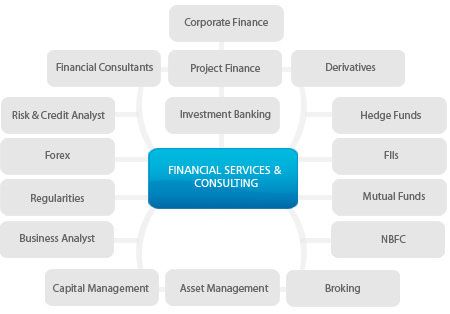

Financial strategy consulting is an essential component of business success in today’s complex and constantly evolving economic landscape. Organizations across industries seek the expertise of financial strategy consultants to navigate challenges, streamline operations, and maximize profits. This article explores the importance of financial strategy consulting and its benefits for businesses.

Understanding Financial Strategy Consulting

Financial strategy consulting refers to the process of analyzing and developing effective financial strategies to achieve business objectives and optimize financial performance. It involves comprehensive assessments of an organization’s financial practices, identifying areas for improvement, and providing strategic recommendations for long-term success.

Role of Financial Strategy Consultants

Financial strategy consultants play a crucial role in assisting businesses with making informed financial decisions and mitigating risks. They possess specialized knowledge in financial analysis, forecasting, planning, and budgeting, enabling them to provide valuable insights and guidance.

Benefits of Financial Strategy Consulting

Improved Financial Performance

One of the primary benefits of financial strategy consulting is the improvement of an organization’s financial performance. Consultants assess existing financial practices, identify inefficiencies, and develop strategies to optimize cash flow, reduce costs, and increase profitability.

Risk Mitigation

Financial strategy consultants are experts in identifying and minimizing financial risks. By conducting comprehensive risk assessments, they can help businesses develop strategies to mitigate potential risks, such as market volatility, regulatory changes, or economic downturns.

Strategic Decision-making

Financial strategy consultants provide invaluable guidance to business leaders in making strategic financial decisions. They utilize financial data analysis and forecasting techniques to assist in evaluating investment opportunities, mergers and acquisitions, and expansion plans, ensuring that decisions are backed by solid financial reasoning.

Efficiency Enhancements

Financial strategy consultants help organizations streamline their financial operations by identifying areas of inefficiency and suggesting improvements. This could involve implementing automated financial systems, enhancing accounting processes, or optimizing resource allocation to maximize productivity.

Industry-specific Expertise

Financial strategy consultants often specialize in specific industries, allowing them to offer tailored solutions and insights. Their deep understanding of industry trends, regulations, and best practices helps businesses stay ahead of their competitors and make informed financial decisions within their respective sectors.

Engaging a Financial Strategy Consultant

Factors to Consider

Expertise and Experience

When selecting a financial strategy consultant, it is crucial to assess their expertise and experience. Look for consultants who have a proven track record of successfully assisting businesses in achieving their financial goals. Industry-specific experience is also valuable, as it ensures a deep understanding of the unique challenges and opportunities within a particular sector.

Reputation and References

Research the reputation of potential financial strategy consultants by reading client testimonials and reviews. Additionally, ask for references and reach out to previous clients to gain insights into the consultant’s performance, reliability, and professionalism.

Fee Structure

Ensure that the fee structure of the financial strategy consultant aligns with your business’s budget and needs. Some consultants may charge an hourly rate, while others may have fixed project fees. Discuss this aspect openly and establish clear expectations regarding costs and deliverables.

Collaborative Approach

Effective financial strategy consulting requires close collaboration between the consultant and the business. Choose a consultant who values open communication, listens attentively to your needs, and involves your team in decision-making processes. This collaborative approach fosters a more productive and beneficial partnership.

Conclusion

Financial strategy consulting serves as a critical tool for businesses to optimize financial performance, mitigate risks, and make informed strategic decisions. By engaging the expertise of financial strategy consultants, organizations can enhance their efficiency, profitability, and overall success in today’s dynamic business environment. When seeking financial strategy consulting services, consider the factors outlined in this article to ensure the selection of a consultant who best fits your business’s unique needs and objectives.